How to Stop My Car From Being Repossessed Hundreds of car owners are now being burdened with financial difficulty and some often wonder what happens if your vehicle gets repossessed? So, let us look into the matter in detail from various perspective.

The Repossession Process

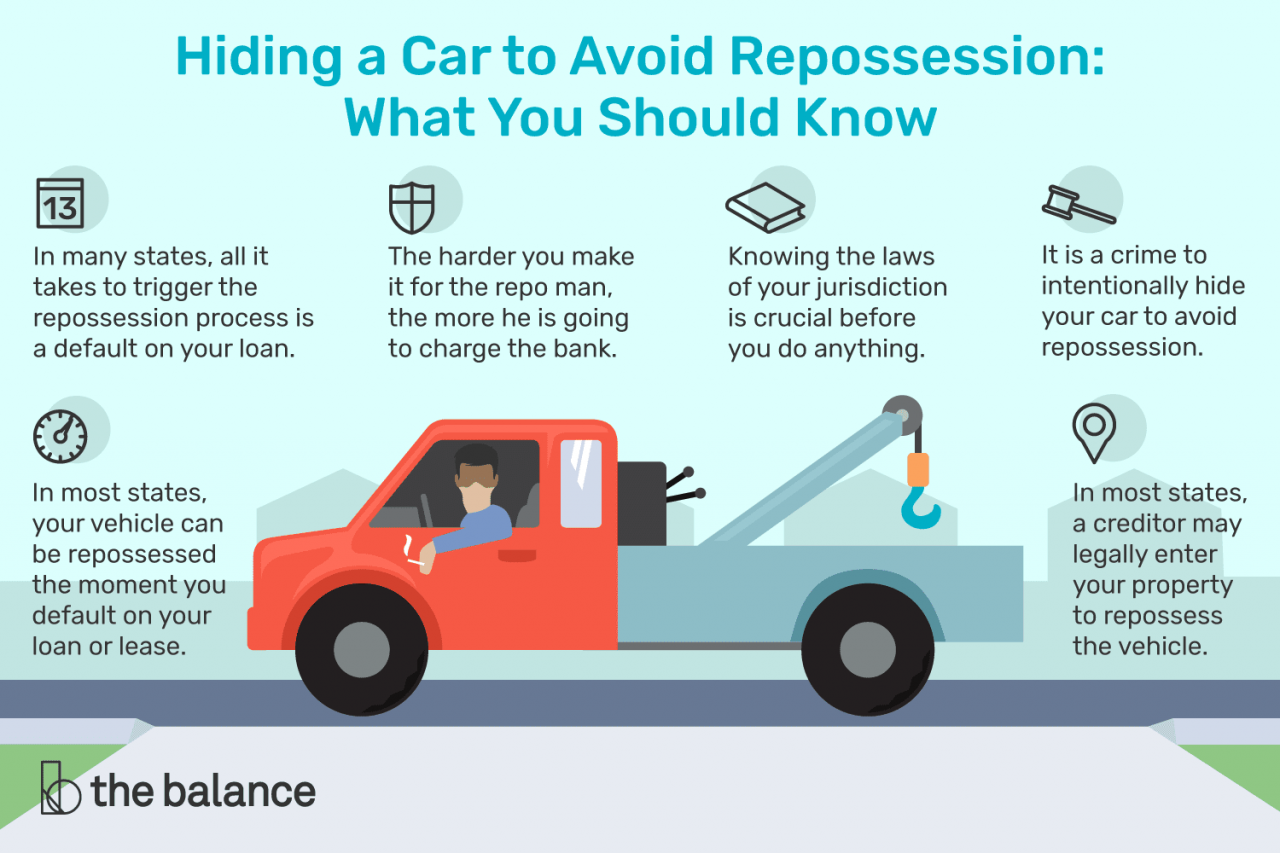

If you continue to not make payments on your auto loan, the lender can take steps toward repossessing it. In many states, this can happen without warning: sometimes with just one missed payment. It may then send an agent to repossess the vehicle, which can occur within a few days of defaulting on the loan13.car repossession (ad)

Simply put, Voluntary Surrendering V2-0S Involuntarily Repossessed

Another approach that borrowers have the option of taking is a voluntary repossession. What this means is, instead of the bank repossessing your car like they can do when you have a loan –>

YOU tell the lender that you cannot make payments anymore and set it up for them to get their car back themselves. This strategy, in turn can save you additional costs associated with an involuntary repossession which would charge for towing and storage if allowed25.

Involuntary repossession, however carries with it unexpected headache and responsibility. The repo agent hired might add onto your debt fees/charges which will then need to be paid, this is considered a cost in respossion by the lender45

Financial Consequences

Whether or not you give up your car of your own free will, it is repossessed forcibly; the sale price might result in a debt remainder. In the case where a car sells for less than what is owed on the loan, that difference (called deficiency balance24) MAY be collected from you.

Legal Rights and Obligations

There are legal procedures in place that must be followed if your vehicle is repossessed. They are not authorized to break the peace of this step, which means that they cannot compel or intimidate. Also, when a repossession does take place they must let you know afterwards that you still owe money and if there are any charges34.

Options After Repossession

If your car has already been repossessed, other options exist:

Pros of Reinstating the Loan You can potentially reinstate your loan, which means that you pay all delinquent amounts AND any fees.

Vehicle Redemption: The process of paying off the entire balance due on the amount that you financed and any extra fees.

Repossession Auction Bid: Want to get your car back?

In some cases, bankruptcy may provide short-term respite from repossession actions while allowing time to regroup the finances4.

If know the how repossession works, you can handle your situation in case of a car repo much better.