Know About Credit Repair After Bankruptcy Recovering from a bankruptcy, especially a Chapter 13 represents an important process for the vast majority of people who are there to write their financial health. The time frame for post-bankruptcy credit repair is different depending on the individual and how much they did to improve their credit while repaying creditors.

Timeline for Credit Recovery

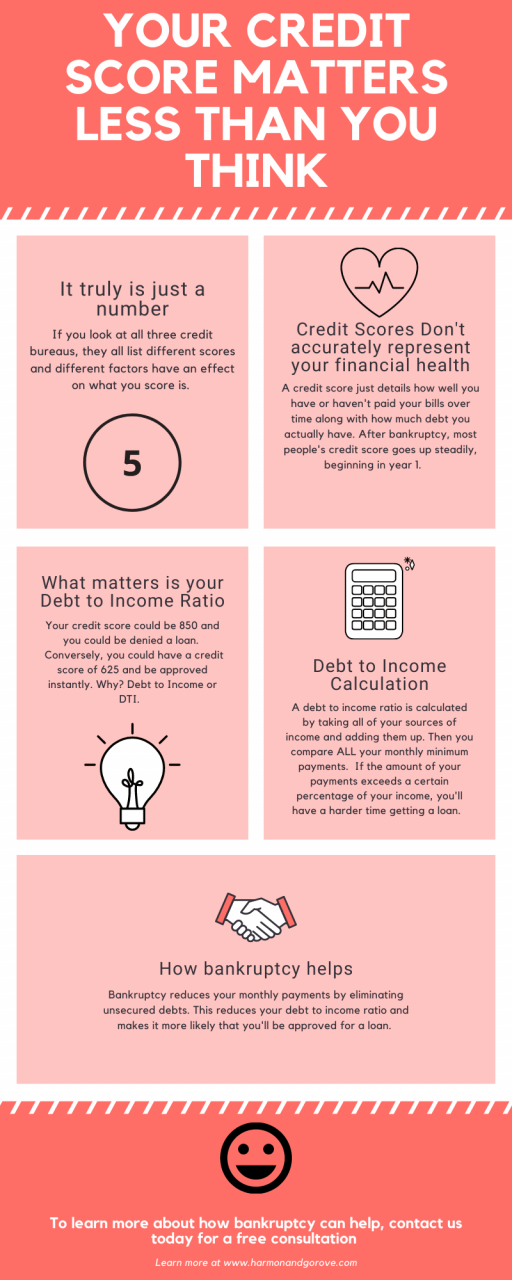

Most of the time, credit scores do not start to rise again until at least 12 or 18 months after a Chapter13 bankruptcy is discharged. Offers a period in which consumers can build payment history and lower their credit utilization — two of the most critical factors for any scoring model12.

What Are the Things that can Affect an Increase in Your Credit Score

The speed and effectiveness of the credit repair process after bankruptcy are subject to a wide variety of factors:

35% of your credit score is based on Payment History By paying off your bankruptcy through the Chapter 13 repayment plan on time every month, you’ll be demonstrating a solid payment history which can help out in improving your score23.

Debt-To-Income Ratio – How much of your monthly income goes towards debt payments that count for 30% of a credit score. If you pay your debts down thru the chap 13 this ratio gets better and can help get your credit score up a little.34

Credit Utilization: Low balances on revolving credit accounts So having a lower utilization ratio can help you scores, as this demonstrates responsible credit management45.

Increasing Credit Recovery Techniques

A few ways that individuals can speed recovery include:

Challenge Inaccuracies: Speaking to credit bureaus about errors will result in a faster score rise, assuming they are removed1.

Open New Credit Lines: Taking out new credit and making sure that you make regular minimum payments may be an aid in rebuilding your credit. Yet we must tread cautiously here as not to over-leverage26.

Interact with Service Providers: Prompting utility and service providers to report payment histories can also help display good repayment behavior1.

Finally, while you may have some steps to go on the path back up after a Chapter 13 bankruptcy discharge (regardless of how much help from your attorney) — generally around 12–18 months before it starts showing green again with everything else repeating every couple weeks — if people are careful about managing their money and do what they should that is only temporary as well.credit repair (ad) Their financial recovery begins with timely payments, lowering debt and removing inaccuracies reported.